Chapter 2: From Construction to GDP, How Civil Infrastructure Fuels the Economy

The second core course, Macroeconomics, focused on critically interpret the economic context and acquire knowledge of economic systems, so to be able to apply the principles of economics to the decision-making processes of companies according to the macroeconomic context in which they operate.

In this article I will introduce the main factors that drive GDP growth and how governments and central banks can control inflation balancing expansionary/contractionary fiscal and monetary policies.

Subsequently, I will explore the investments in energy transition made by the leading economies - such as Europe, the USA, China.

Finally, I will delve into the Civil Infrastructure industry, focusing on the civil infrastructure sector's potential to influence macroeconomic factors. I will highlight how this sector can drive expansionary fiscal policies, contribute to GDP growth, and shape corporate strategies for the future.

Hydroelectric Power Plan for Energy Transition

The Distinction Between Long-Run and Short-Run GDP Growth

Understanding how GDP growth differs in the long and short run is essential for analyzing the political decisions that governments make and their subsequent economic impacts.

In the long run, GDP growth is influenced by two main factors: technological progress (driven by investments in technology and R&D) and the accumulation of resources (investments in physical and human capital). Societies (thus governments) must balance these two aspects by allocating resources to meet current needs and investing in technology to secure future growth. This trade-off between immediate consumption and long-term investment is inherently political.

Financial markets play a crucial role in bridging this trade-off: Governments can raise funds by issuing securities (like bonds), challenging private saving and investing them promising future growth, despite the raise in public debt. These bonds essentially function as a form of "crowdfunding" for national projects, offering returns to investors who believe in the government's progress. While over-simplified, this analogy aims to capture the essence of how financial markets can support GDP growth.

Additionally, the population growth can influence the GDP growth. However, while an increasing in population may not necessarily convert into a more efficient production (see China Vs USA). To measure the productivity, GDP per capita is a better metric rather than the total GDP, since it reflects the nation's efficiency regardless its size.

On the other hand, in the short-run, Keynesian models are instrumental in driving expansionary or contractionary policies to address contingent economic imbalances whether to mitigate recessions or curb excessive growth with a consequent increase in inflation.

Current macroeconomic situation

At the beginning of 2023, the study "Firm Inflation Expectations in Quantitative and Text Data" surveyed firms on the factors that most likely affects their pricing and CPI inflation.

Labour emerged as a critical factor due to its direct impact on productivity and wages. Rising wages increase production costs, feeding into higher prices and increasing inflation. Moreover, the IMF cautioned against a wage-price spiral, where rising wages and prices fuel each other, driving sustained inflation.

Energy, meanwhile, plays a dual role. The climate crisis and geopolitical tensions, such as the Ukraine–Russia war, exacerbated the situation. Europe's reliance on Russian fossil fuels was heightened vulnerabilities, with soaring energy costs directly affecting inflation. Despite international efforts like the Kyoto Protocol (1992) and the Paris Agreement (2015), meaningful progress on reducing emissions remained limited, emphasising the urgent need for a transition to renewable energy sources.

Policy Challenges in an Unprecedented Context

Theoretically, Keynesian models suggest inflation typically rises when unemployment is low, GDP nears its potential, and consumer spending is high. In such scenarios, contractionary monetary policies — raising interest rates to reduce spending — are effective tools. And this happened since the end of Covid-19.

However, Europe’s inflation, surpassing 10% in 2022, was largely driven by exogenous shocks: the energy crisis and war. These events reverberated across global economies, amplifying inflationary pressures worldwide. In this context, relying solely on contractionary monetary policies may not be sufficient. High interest rates risk curbing production, reducing disposable income, and dampening private consumption and investment.

A Balanced Policy Approach

Addressing inflation in today’s environment requires a combination of monetary and fiscal policies. While monetary tightening can temper inflation, fiscal policies must address structural issues, particularly in energy production. Investments in advanced renewable technologies can reduce fossil fuel dependency, lower energy costs, and stabilize prices. Without such measures, the entire world risks prolonged recession due to weakened aggregate demand components.

Relying solely on monetary policy appears insufficient in the current context, and the costs of this approach could outweigh the benefits. Europe, for example, has faced significant economic challenges over the past decade due to stringent monetary policies paired with austerity-driven fiscal measures.

Similarly, Australia illustrates how monetary tightening without synchronized fiscal interventions can strain the economy. Higher interest rates may reduce inflation, but what is the cost that the community has to pay for this? Increasing the interest rate contains the inflation, as we have seen happening in the last 2 years, but it will also lower the production, the disposable income, thus the private consumption of consumers (increasing the propensity to save money). At the same time the higher interest rate will reduce the private investments too. This, in turn, hampers GDP growth, ultimately risking broader economic stagnation.

In such a scenarios fiscal policies are a critical lever, as the only component that can be forced in the aggregate demand is the public consumption. If this is not done, the concatenation of reduction in the components of the aggregate demand will be reflected in a quite long recession period, regardless the inflation level.

On regard of this, I would like to recall what Ms Bullock, the current Governor of RBA in Australia, aptly noted: “The private sector is growing “very slowly” in Australia at the moment, with consumption per capita declining, and government spending is actually providing crucial support. If it wasn’t there, if it wasn’t filling that gap, then things might well be much worse in terms of the employment market”.

Her statement underscores the importance of synchronizing monetary and fiscal policies to maintain a healthy economic system.

However, Australia’s recent slow inflation reduction is partially attributable to persistent inflationary pressures in specific sectors, such as the real estate market and primary consumer goods like food.

A lack of oversight has allowed unethical corporate practices, such as profit margin hikes by major grocery chains like Coles and Woolworths, to exacerbate inflation. Such behaviors undermine efforts to stabilize the economy, forcing central banks to implement more aggressive monetary policies. This further penalizes GDP growth, as evidenced by Australia’s slowest economic expansion in decades.

The role of Civil Infrastructure in Macroeconomic Scenarios

Economic growth is often fuelled by strategic infrastructure investments. Highways, bridges, railways, and transit systems form the backbone of modern economies, facilitating the efficient movement of goods, people, and services. But how do these projects translate into broader economic benefits, and what role does the Civil Infrastructure industry play in driving these outcomes?

The answer lies in the multiplier effect of large-scale projects. Government investments in infrastructure inject money into the economy, which circulates, boosting aggregate demand and overall economic growth. Additionally, such projects enhance societal efficiency. For instance, improved transportation infrastructure reduces travel times for goods, optimizing supply chains. Similarly, transitioning to renewable energy — like constructing a power plant that serves an entire town — lowers carbon emissions while meeting energy demands sustainably.

These investments don’t just address one problem; they solve multiple challenges simultaneously. A well-planned infrastructure project can reduce costs, enhance sustainability, and support economic growth. As governments globally allocate substantial resources toward energy transition, the Civil Infrastructure industry stands at a pivotal moment.

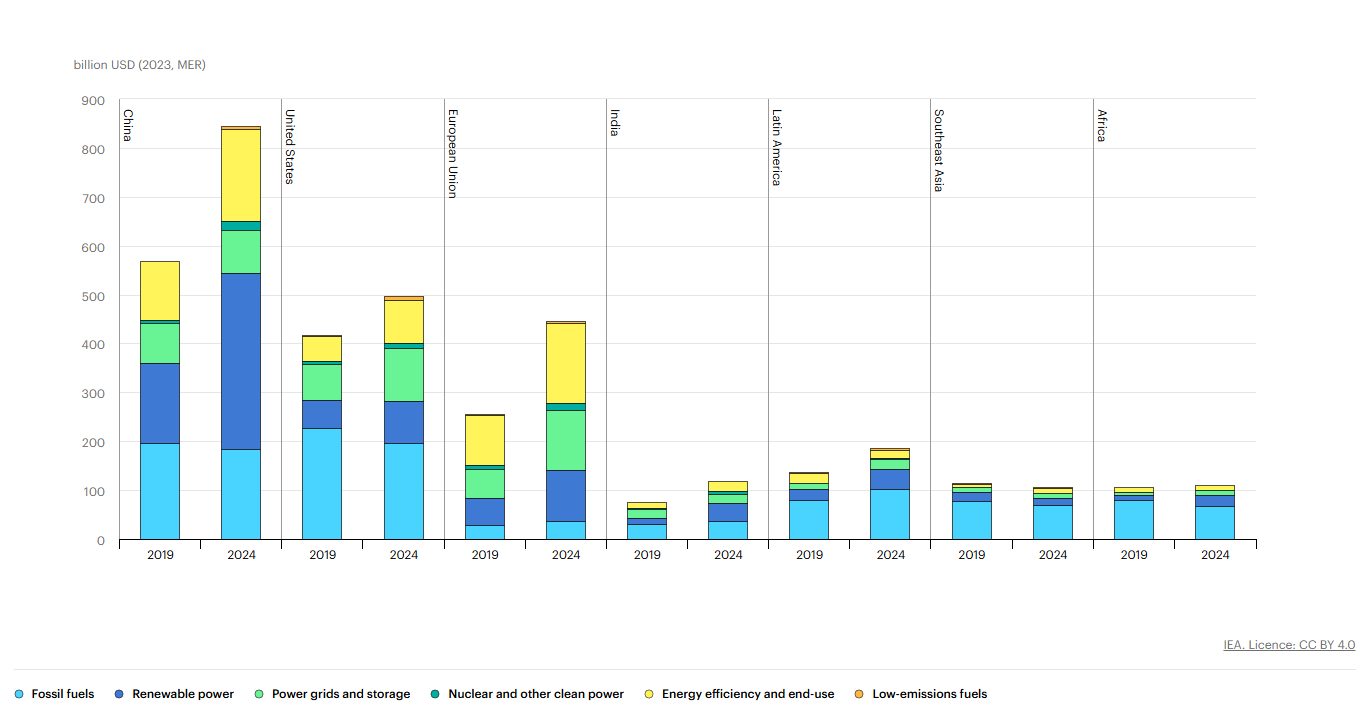

Globally, many economies are increasing investments in advanced renewable energy to achieve the right balance between monetary and fiscal policies, foster economic growth, and secure a sustainable future for coming generations.

Let me now examine how key players in the global economy — Europe, the USA, China, and Australia — are tackling these challenges.

Country/Region | Investment Amount | Key Initiatives | Timeline |

|---|---|---|---|

China |

| Ongoing, with significant acceleration since 2020 | |

United States |

|

Accelerating since 2022

| |

Europe

|

|

Ongoing, with increased focus since 2020

|

To capitalize on this opportunity, companies in the Civil Infrastructure sector must strengthen their capabilities in sustainable infrastructure and renewable energy projects. By aligning with future trends and focusing on innovative solutions, they can contribute to the public expenditure necessary to sustain GDP growth while positioning themselves for long-term success in an evolving market.

Now, based on the article, if you were the CEO of a company working in the Civil Infrastructure industry, where would you look at and which strategy would you put in place for the next 10 years?

My EMBA journey continues to inspire me to think about strategic decisions and leadership behaviors that position our teams and clients for success in a fast-changing world.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of my current or former employers. The framework, technologies, and methodologies discussed are based on the author’s personal insights and experiences. This article is intended for informational purposes only and does not represent my employer’s proprietary solutions or corporate strategies.

Christian Pallaria

"Success begins with a strategy. A strategic plan is your roadmap to achieving your destination."